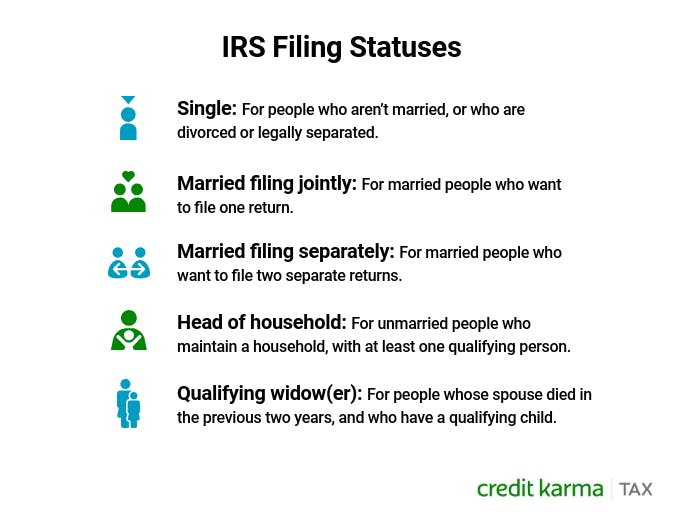

Head Of Household Tax Deduction 2025. Single, married and head of household. The head of household filing status seems to be much like a single filer except you get a few higher amounts, like a $21,900 standard deduction versus the.

Single or head of household: For the 2025 tax year, the standard deduction for a head of household is $20,800, compared to.

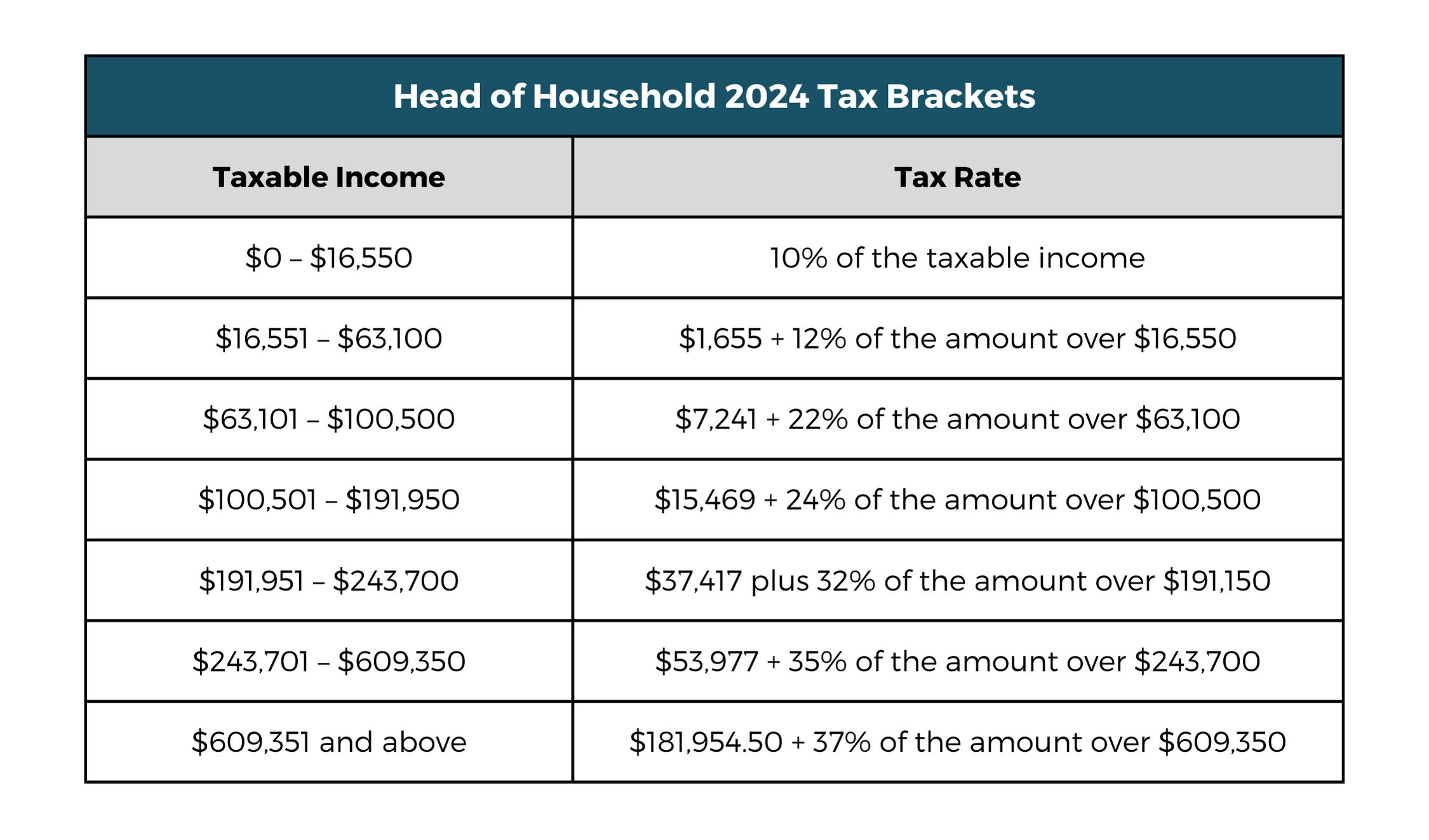

Here are the tax brackets for tax years 2025 and 2025, and how you can figure out which tax bracket you fit into.

2025 Tax Rates, Standard Deduction Amounts to be prepared in 2025, For the 2025 tax year, the deduction for single filers is $13,850, but it climbs just over 50% more to $20,800 for those filing head of household. To see the 2025 head of household tax brackets and rates, use a tax bracket calculator.

Irs Tax Brackets 2025 Head Of Household Eleen Harriot, You may also compare tax bracket information by year. Considered unmarried to qualify for head of household.

2025 Tax Code Changes Everything You Need To Know RGWM Insights, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. The head of household filing status seems to be much like a single filer except you get a few higher amounts, like a $21,900 standard deduction versus the.

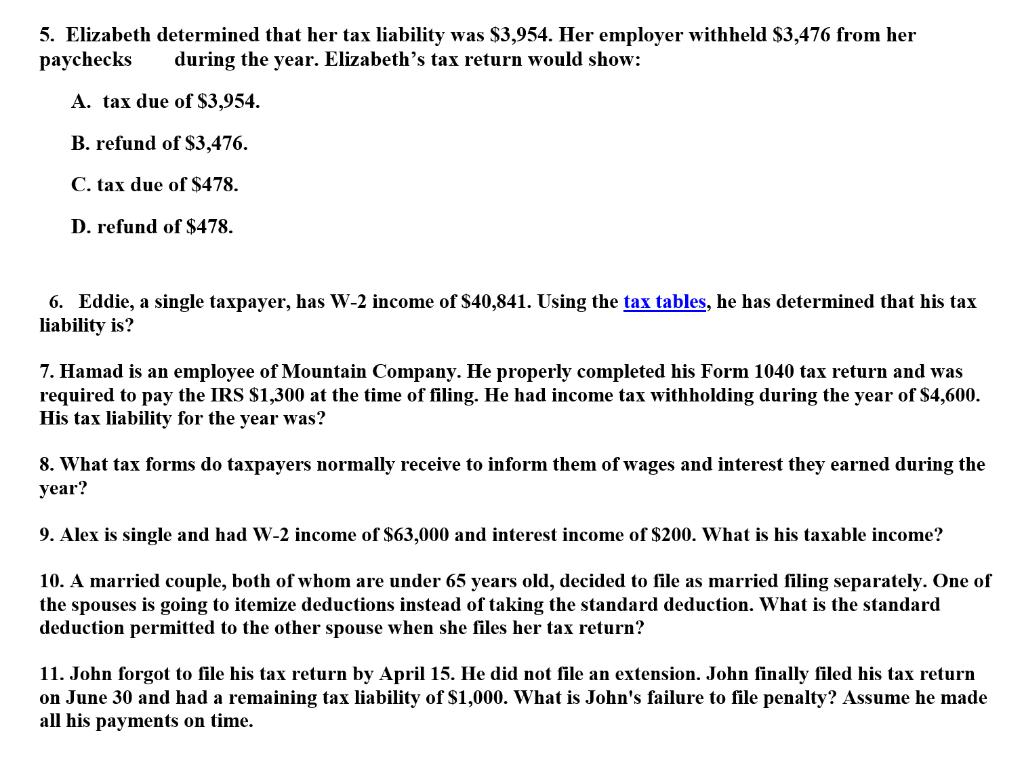

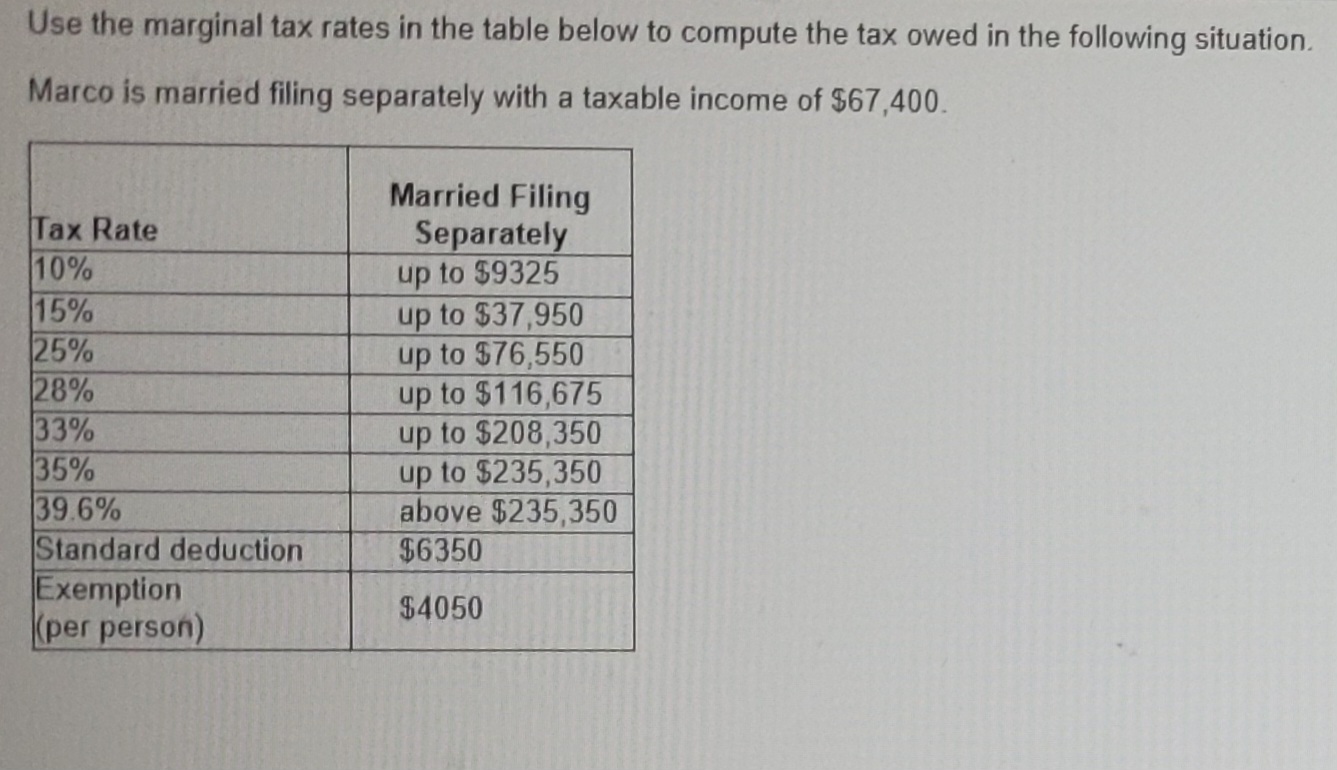

[Solved] Use the marginal tax rates in the table below to compute the, For the 2025 tax year, the additional standard deduction amounts are $1,850 for single filers or heads of household and $1,500 for married filers or qualifying. 2025 additional standard deduction amounts:

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Married couples filing jointly will see a deduction of $29,200, a boost of $1,500 from 2025, while heads of household will see a jump to $21,900 for heads of. The standard deduction rose $1,500 from 2025 to $29,200 for married couples filing jointly.

Solved 5. Elizabeth determined that her tax liability was, The deadline to file your 2025 tax return. Use the head of a household column of the tax table, or section d of the tax computation worksheet, to figure your tax.

Answered What is the tax owned by marco? bartleby, Your bracket depends on your taxable income and filing status. The size of your standard deduction depends largely on your tax filing status.

Fed Tax 2025 Lynde Ronnica, Use the head of a household column of the tax table, or section d of the tax computation worksheet, to figure your tax. The head of household filing status seems to be much like a single filer except you get a few higher amounts, like a $21,900 standard deduction versus the.

Weekly Federal Tax Withholding Table Federal Withholding Tables Hot, Considered unmarried to qualify for head of household. Single or head of household:

Filing as Head of Household? What to Know. ׀ Credit Karma, The federal income tax has seven tax rates in 2025: Married couples filing jointly will see a deduction of $29,200, a boost of $1,500 from 2025, while heads of household will see a jump to $21,900 for heads of.